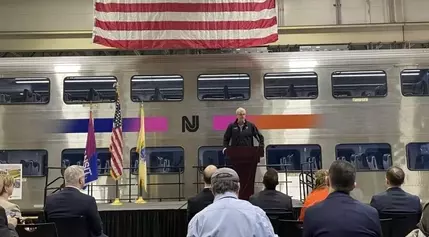

Transforming New Jersey's Rail Network: A Journey of Innovation and Reliability

NJ Transit is investing 0 million to upgrade its rail fleet with 174 new double-decker railcars t

Permanent Blush: The Unexpected Beauty Trend Sparking Debate

The article discusses the growing trend of cosmetic tattoos, specifically the blush semi-permanent t

Marrakech Muse: Imaan Hammam's Captivating Journey at the Fashion Trust Arabia Awards

Imaan Hammam, a model with Moroccan roots, was excited to attend the Fashion Trust Arabia (FTA) Awar

Elevating the Game: NHL's Stylish Collaboration with Lululemon and Fanatics

The National Hockey League has announced a new partnership with Lululemon and Fanatics to launch a p

Unwrap the Beauty Bliss: M&S Unveils Unparalleled Advent Calendar for 2024

Marks and Spencer has unveiled its 2024 beauty advent calendar, packed with a variety of beauty prod

Preserving Video Game History: A Challenging Legal Landscape

The US Copyright Office has rejected an exemption proposed by the Video Game History Foundation (VGH

Bipartisan Gaming: Lawmakers Tackle Politics and Football

The article describes a gaming session between Minnesota Governor Tim Walz and Representative Alexan

Aroostook County Tackles Opioid Crisis with Innovative Grant Program

Aroostook County in Maine is set to receive .69 million in opioid settlement funds over the next 1

Sheboygan's Thriving Theater Scene: Auditions, Musicals, and Independent Productions

The article discusses upcoming theater events in Sheboygan, Wisconsin. Theater for Young Audiences w

Dodgers on Brink of Second World Series Title in Five Years

The Los Angeles Dodgers are one win away from clinching their second World Series title in five year

The Voice's Coaches Forge Unbreakable Bonds, Elevating Season 26 to New Heights

The current season of The Voice has been marked by a strong camaraderie among the four superstar coa

Rethinking the Role of UNRWA: A Necessary Shift Towards Accountability and Transparency

The article discusses the end of UNRWA's operations in Israel and the West Bank, arguing that the ag

Navigating the Spooky Spectrum: A Family's Guide to Age-Appropriate Horror Movie Marathons

The article discusses the challenges of finding age-appropriate horror movies for young viewers, par

The Culinary Supremacy of the City of Angels: Why Los Angeles Reigns Supreme Over New York in the Gastronomic Realm

The article argues that Los Angeles is a superior food city compared to New York. It highlights the

Intoxicated Driver Arrested with Teenager in Vehicle: A Cautionary Tale

A 32-year-old Lincoln woman was arrested on suspicion of driving under the influence with a teenager

Blonzing: The Latest Beauty Trend Taking Over TikTok—But What Is It?

The article discusses the latest beauty trend called "Blonzing" that is sweeping TikTok. It involves

Video: Lupita Nyong’o shares her Life Lessons

Lupita Nyong'o, the Oscar-winning actress, admits that creativity doesn't come easily to her despite

Preserving Gaming History: The Uphill Battle for Legal Access

The article discusses the legal challenges faced by video game preservationists in accessing and pre

Balatro's Eclectic Expansion: A Delightful Fusion of Indie and AAA Favorites

The article discusses the latest free update for the game "Balatro," which features a collaboration

Resilient Nonprofit Refuses to Let Thieves Dampen Their Holiday Spirit

The nonprofit organization B.I.G Love Cancer Care has faced a series of thefts from their storage un